| |

Posted Jun 24, 2008, 5:27 PM

Posted Jun 24, 2008, 5:27 PM

|

|

Registered User

|

|

Join Date: Apr 2007

Posts: 465

|

|

|

Regina, Saskatoon & Winnipeg now the best places to buy a home in Canada

Looks like things are not going to cool down anytime soon guys! Our Report Cards have very high marks!

Quote:

Real estate: Where to buy now

Duncan Hood, Moneysense

Real estate agents like to tell you that what matters is location, location, location. They're partly right. But what also matters is timing, timing, timing. Every city moves to its own economic rhythms. Smart real estate investing is a matter of knowing when to jump into the market and when to stay out.

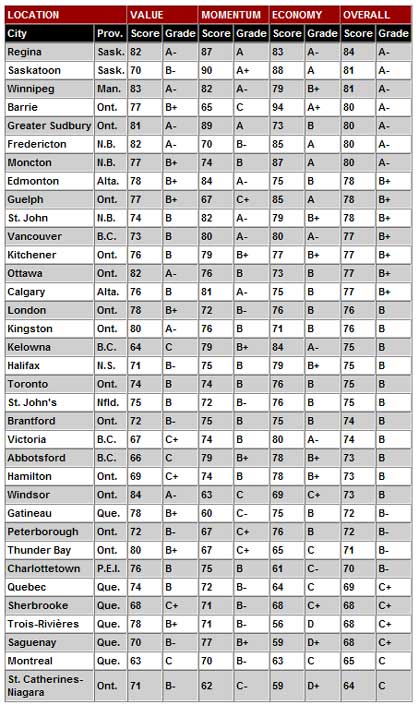

How do you know when the time is ripe? Rather than relying upon gut feel, we decided to take a more scientific approach to the question. We compiled data on the 35 major markets tracked by Canada Mortgage and Housing Corp. We analyzed each market in three different ways — by Value, by Momentum, and by Economic Strength. We assigned each market a letter grade in each of the three categories, then combined all that info into one overall grade. We awarded an A to the top 20% of cities. Average prospects had to make do with a B, while lacklustre prospects were handed a C or worse.

Many individual factors went into each grade. To calculate Value, for instance, we began by comparing average rents to average home prices, since we figured that the most basic indicator of a home's value is how much rent it can put in your pocket. High rents indicate that, if you were hit by a financial crisis, you could rent out your home for a reasonable sum. Even if you never plan to rent out your home that is still a comforting thought.

To help us gain an even better sense of a city's Value, we looked at local wages and figured out the number of years of average household income that it would take to purchase the typical local home. We downgraded communities where local residents couldn't afford to buy homes easily; we gave highest marks to cities where they could. Our reasoning was that places where homes are affordable are places where real estate prices are solidly rooted in economic fundamentals and are therefore unlikely to plunge. The differences between communities can be huge. In Regina, a typical family needs two-and-a-half years of income to buy a home; in Vancouver, a typical family needs nearly eight years of income. Talking strictly in terms of bang for buck, Regina is a much better place to buy.

But, of course, Value isn't everything. Some cities have enjoyed surging real estate markets for reasons that have little to do with local rents or typical wages. Some of these red-hot markets are cities that have lured outsiders with their natural beauty (think Vancouver); others are communities that have enjoyed bonanzas because of skyrocketing oil prices (that's you, Calgary).

To give these cities their due we rated each of our 35 cities on Momentum, a measure of how hot each market is. To gauge Momentum, we looked at home sales in comparison to new real estate listings — a high number of sales-to-listings indicate that homes are selling relatively quickly and market momentum is therefore high. We also looked at how much home prices in each city have gone up over the last year and over the last four years. To top things off, we considered how much rents have gone up over the past four years, since rapidly rising rents indicate a community with pent-up demand for housing. If you've been following the real estate news, it probably won't surprise you to learn that the runaway winners in our Momentum survey are Regina and Saskatoon.

The problem is that the same forces that conspire to drive up prices in a city can also turn in the opposite direction. To avoid being taken in by cities with weakening economies, we devoted our final grade to Economic Strength. We looked at how fast each community grew between 2001 and 2006 (the most recent year for which figures are available). We also factored in unemployment rates (based on 2007 data) and discretionary income levels, as well as a forecast from Canada Mortgage and Housing for unemployment in each city in 2008. The Economic Strength grades that resulted from all this number crunching held some surprises: it turns out that mighty Toronto and bustling Calgary have weaker economic outlooks than Fredericton and Barrie, Ont.

Finally, we rolled our grades for Value, Momentum and Economic Outlook into one overall grade for each community. We had no runaway winners, but we did find seven cities that deserve an A-. They're a diverse lot. At the top are three Prairie cities — Regina, Saskatoon and Winnipeg — with relatively low home prices, strong momentum and good economic prospects. Just behind is Barrie, where home prices are higher and momentum is weaker, but the economic outlook is outstanding. By comparison, Sudbury, another mid-sized Ontario city, offers better home prices and stronger momentum, but dimmer economic prospects. Finally, Fredericton and Moncton demonstrate that New Brunswick has a lot to offer bargain hunters, especially as the province’s economy shows signs of life.

Our analysis suggests you can find decent prospects in each part of Canada. We caution you, though, to use our results with care. Nobody can gauge what a city's economy will be like in 10 years. Our research, though, can help you analyze each city's current strengths. And that's a good starting point for any investor.

Go West, young investor

Three Prairie cities top our list of best places to buy now

|

link

cheers to Regina, Saskatoon, & Winnipeg!

|

|

|