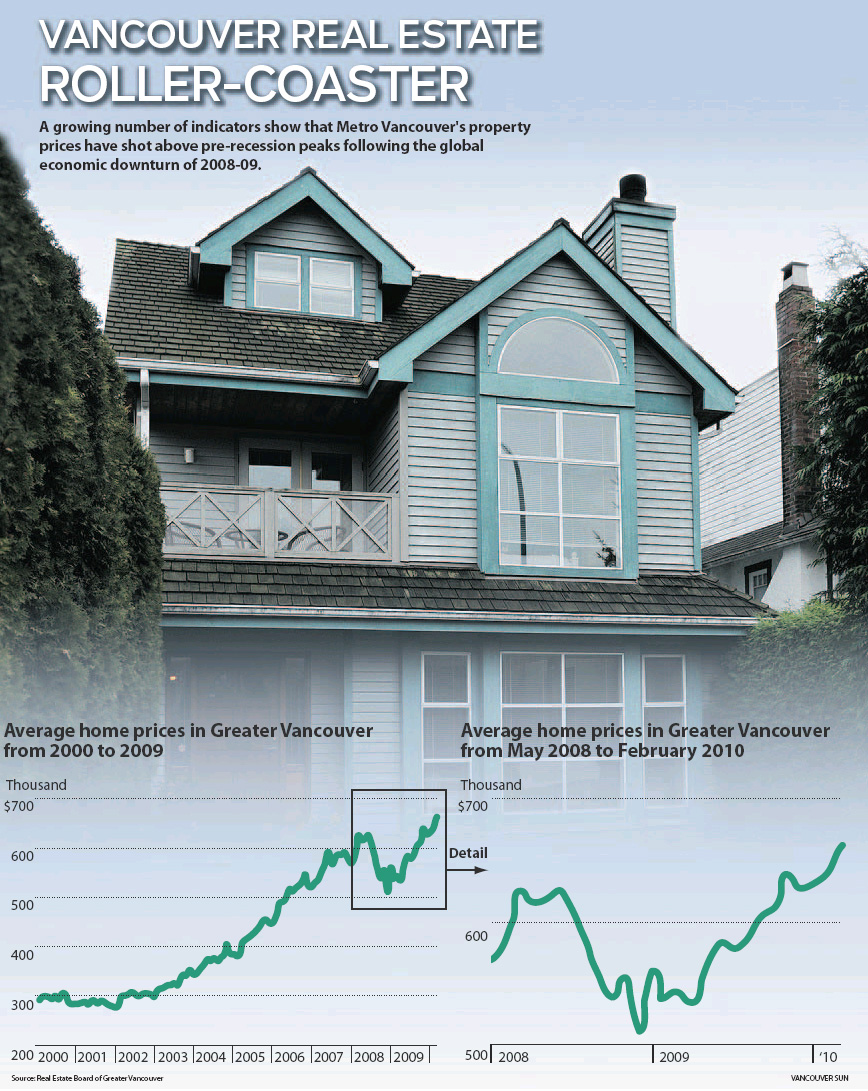

Average price of Metro Vancouver home now almost $663,000, above pre-recession levels

Derrick Penner

Sun

Thursday, April, 01, 2010

Metro Vancouver's cheap-mortgage-fuelled real estate market has overshot its previous peak for prices with indications it will keep going, albeit more slowly, before cooling with the rise in interest rates.

February saw the average property price hit $662,741 in the area of Metro Vancouver within the Real Estate Board of Greater Vancouver. (The board does not cover Surrey, Langley or White Rock.)

That is well above the previous $624,639 peak price, which the region saw in May 2008.

Now, the Teranet-National Bank housing price index, a more complicated measure of property prices that analyses data from the repeat sales of homes, also indicates that all the deflation of home prices that occurred during the recession had been regained by January, and will keep going, but more slowly.

The Teranet-National Bank index, which runs a couple of months behind the reports of real estate boards, found January was the ninth month in a row that the national price index increased, though it did so by the smallest margin in the past nine months.

"Even in Vancouver, we've gained back everything we lost," Simon Cote, an analyst at the National Bank of Canada said in an interview. "The pace might be slowing a bit, but they are still going up."

Metro Vancouver prices, on the Teranet-National Bank index, reached their recession trough in May 2009, but rose 11.7 per cent between May and January.

Metro Vancouver prices rose .9 per cent between December and January, the biggest gain among the six major markets included in the Teranet-National Bank index.

National Bank analyst Marc Pinsonneault, in a note to clients, said the January price increases can still be considered "vigorous, especially in Vancouver and Toronto," but that developments in most markets back up National Bank's view that increases will slow down.

Pinsonneault said that after eight months of briskly rising prices, Metro Vancouver's market has "shifted from a favourable-to-sellers market to a balanced market."

Cote added the bank is "expecting that the increase in supply, both of new construction and more homes coming to the [resale] market, will bring the market back into equilibrium."

Mortgage rates will also be a factor. Canada's major banks raised their posted rates on five-year fixed mortgages .6 of a percentage point on Monday and Tuesday to 5.85 per cent, which will squeeze some buyers out of the market, according to Cameron Muir, chief economist for the B.C. Real Estate Board.

"What it means for purchasers is that it erodes their purchasing power" by reducing the size of mortgages buyers are capable of carrying, he said.

For a family with a household income of $70,000, Muir said, this week's bump in five-year rates for buyers seeking five-year terms reduces the final amount they can pay for a home by $35,000.

The increase, he added, "is a fairly hefty lift."

© Copyright (c) The Vancouver Sun